Retirement Income Strategies for a Secure Future

Effective retirement planning and expert wealth preservation strategies ensure a secure tomorrow by utilizing tax-efficient strategies.

Effective retirement planning and expert wealth preservation strategies ensure a secure tomorrow by utilizing tax-efficient strategies.

In retirement planning, it's crucial to consider how long your money will last, the impact of the IRS, and your exposure when income ceases. All of this should be done while implementing tax-efficient strategies that promote wealth preservation.

Welcome to SRG Wealth Preservation LLC

At SRG Wealth Preservation, we specialize in strategic wealth architecture for individuals, families, and business owners who seek more than traditional financial planning. Our focus on wealth preservation ensures that our clients protect what they’ve built, minimize unnecessary taxes, and implement tax-efficient strategies that create legacy plans lasting for generations. We offer coordinated solutions that integrate retirement planning, tax planning, trusts, life insurance, and asset protection.

Our approach transcends mere products and projections. We prioritize structure over speculation, planning for critical life events such as business exits, retirement transitions, liquidity events, and estate transfers to prevent costly mistakes before they happen.

If you’re seeking clarity, control, and confidence in your financial future—welcome. You’re in the right place.

In retirement planning, it's crucial to consider how long your money will last, the impact of the IRS, and your exposure when income ceases. All of this should be done while implementing tax-efficient strategies that promote wealth preservation.

At SRG Wealth Preservation, we understand that wealth isn’t solely about accumulation — it’s about how effectively you preserve, control, and pass it on.

We collaborate with business owners, high-net-worth families, and individuals approaching key financial transitions to create strategic wealth preservation blueprints that safeguard assets from unnecessary taxation, market volatility, and legacy erosion. Our focus includes retirement planning to ensure a secure financial future.

Our firm specializes in advanced planning strategies traditionally utilized by the ultra-wealthy, including Charitable Remainder Trusts (CRTs), Irrevocable Life Insurance Trusts (ILITs), Dynasty Trusts, and tax-efficient strategies for income generation, alongside coordinated exit planning. These tools are not merely theoretical; they are actively implemented, stress-tested, and tailored to meet each client’s real-world objectives.

A Different Kind of Advisory Firm

While most financial planning emphasizes accumulation, we prioritize distribution, protection, and legacy preservation.

At SRG Wealth Preservation, we serve as your Wealth Architect — integrating your legal, tax, and financial professionals to ensure that every decision aligns with a cohesive strategy. We don’t replace your CPA or attorney; instead, we weave them into a comprehensive plan so that nothing is overlooked, duplicated, or misaligned.

This coordinated approach assists our clients in:

- Reducing or eliminating unnecessary capital gains and estate taxes

- Creating reliable income through tax-efficient strategies without excessive market risk

- Protecting family wealth across generations

- Executing charitable giving in the most tax-efficient way possible

- Maintaining control and clarity through life’s significant financial events

Built for Complexity. Designed for Clarity.

Liquidity events, business exits, retirement transitions, and estate planning are not moments for generic advice. They require foresight, structure, and precision.

Our role is to simplify complexity — translating advanced strategies into clear, actionable plans that resonate with your values, your family, and your long-term vision.

Whether you are preparing to sell a business, reposition significant assets, or ensure your legacy is preserved for future generations, SRG Wealth Preservation provides the strategic oversight necessary to protect what you’ve built.

Our Philosophy

✔ Strategy before products

✔ Structure before transactions

✔ Coordination before execution

✔ Legacy over short-term gains

We gauge success not just by returns, but by resilience, efficiency, and permanence.

Who We Serve

- Business owners preparing for exit or succession

- Individuals with significant appreciated assets

- Families concerned about estate taxes and legacy erosion

- Clients seeking tax-efficient income and long-term protection

- Those who desire their wealth aligned with purpose and impact

Strategic Wealth Architecture for Visionaries and Legacy Builders

SRG Wealth Preservation LLC

Because your wealth deserves a plan as sophisticated as the life you’ve built.

Get a FREE retirement review when you sign up for our newsletter!

We love our customers and are here to assist you with retirement planning, tax-efficient strategies, and wealth preservation. Feel free to schedule a call anytime!

Today | Closed |

Get 10% off your first purchase when you sign up for our newsletter!

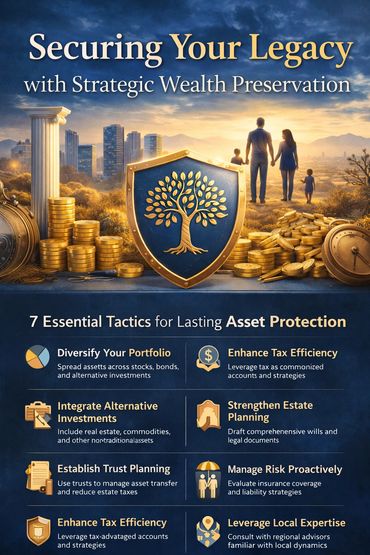

In today’s uncertain financial environment, building wealth is no longer enough. The real challenge is protecting what you’ve worked decades to accumulate.

Market volatility, changing tax laws, and longevity risk have made wealth preservation a critical component of any long-term financial strategy. Without a proactive plan, even well-structured portfolios can erode over time—often when there’s little opportunity to correct course.

This guide is designed to help you understand the core principles

Effective Date: January 4, 2026

Thank you for your purchase from SRG Wealth Preservation LLC. Please review the following policy regarding digital products.

All eBooks and digital products sold or distributed by SRG Wealth Preservation LLC are non-refundable and non-returnable.

Due to the nature of digital content and immediate access upon purchase or download, all sales are final once the eBook has been delivered or accessed.

Once an eBook or digital file has been downloaded, accessed, or delivered electronically:

This policy applies regardless of whether the digital product has been opened, viewed, or partially accessed.

Refunds may be considered only in the following limited circumstances:

Requests for exceptions must be submitted within 7 days of purchase and will be reviewed on a case-by-case basis. Approval is not guaranteed.

All eBooks are provided for educational and informational purposes only. Content does not constitute legal, tax, or investment advice, and results may vary based on individual circumstances.

Purchases are not refundable due to dissatisfaction, change of mind, or perceived outcomes.

If you experience difficulty downloading or accessing your eBook, please contact us so we can assist you:

📧 Email: nicole@srgwealthpreservationllc.com

🌐 Website: www.srgwealthpreservationllc.com

SRG Wealth Preservation LLC reserves the right to modify this Return & Refund Policy at any time. Changes will be effective immediately upon posting.